3/10/2024 - Weekly Recap + Market Predictions

Hi Readers, I hope you are doing well! In this post, I will be covering what my account has been looking like over the past week. Since my positions did not change much over this past week, I will also include the market predictions for the next week in this post as well. I hope you enjoy!

WEEKLY RECAP:

Monday and Tuesday: I did not trade or make any adjustments on my account

Wednesday: I entered a Long QQQ ATM Straddle 10 times in the April 5 expiration date. At the time of purchasing the spread, QQ was near $441, so I purchased the straddle at a $441 strike price. On Wednesday, QQQ was at its high for the day when I purchased the straddles, and for the rest of the day (after I purchased the straddles), QQQ proceeded to go down all the way to around $438, where it ended the day. So, the puts were most likely in the money then.

Thursday: I did not trade or make any adjustments on my account. However, on this day, QQQ made a huge spike up, and ended the day at around $446.

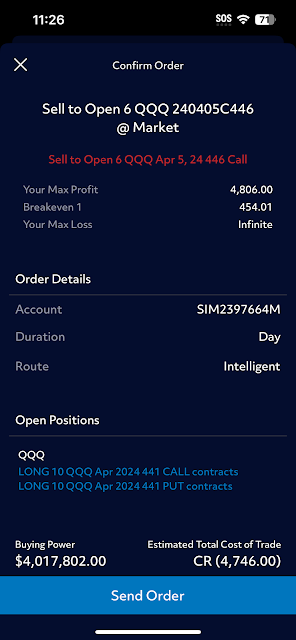

Friday: QQQ started to go up even more, and was at around $448 1 hour after trading opened. This is when I made my adjustment. At this time, I made my adjustment to this position. Since QQQ was much above the $441 strike price of the straddles I had on, now the calls were profiting by about $3000 while the puts were losing money by about $2000. So the overall position was profiting by about $1000. During this time, I also had gained a lot of positive deltas, not to mention the humongous negative thetas my position had due to being net long options. So, to reduce the deltas near 0 and hedge them, I could have either bought puts or shorted calls, and I chose to short calls to also add some positive thetas to my position. I shorted 6 of the April 5 $446 calls, also in the April 5 expiration cycle. This brought my deltas from about 300 to around 30, and my theta from around -330 to around -200. Luckily, QQQ was at a supply zone when I made these adjustments, and QQQ respected the supply/resistance zone and went all the way down for the rest of the day. This made huge profits on the short call, and the puts now made the money while the calls lost money.

Plans for tomorrow (Monday): Currently my overall position is at around -200 delta and around -200 theta. To bring these near 0, I could just short some puts, which would add both positive theta and negative theta to my position. Also, this would turn my overall position into a call spread and a put spread, if I short the puts at a strike price lower than $441. Anyways, that is my plan for tomorrow, and I might also do some gamma scalping to battle the negative theta I have.

I also want to put on one or two more positions, on AMD and SPY, which would be a time spread and another long straddle. Let's see what happens!

MARKET PREDICTIONS:

Right now, I only have a position on for QQQ, so I will do a market prediction for QQQ. Two major things to note are that QQQ established a supply/resistance zone at $446-$448, and a demand/support zone near $433-$435. On Monday, QQQ displayed very low volatility, hovering near about $445. However, within the last 1 hour of trading hours, QQQ plummeted and ended at around $439. On Tuesday, QQQ continued this downward trend for the majority of trading hours, reaching around $433 one hour before trading hours closed. However, during that last hour, QQQ jumped up to end the day at $435. On Wednesday, QQQ opened at around $440, and went down by about $3 in the first hour. QQQ then went up to $441 by the middle of the day, then dipped back to around $437. QQQ ended up jumping back and ending the day at $439. On Thursday, QQQ opened up at around $442, and gradually rose for the rest of trading hours to end the day at around $445. On Friday, QQQ displayed a very high amount of volatility. For the first hour, QQQ rose and reached around $448, then plummeted all the way down to around $438. QQQ then made a small jump back up to around $442 before coming back down and ending the day at around $438. This is a recap of QQQ's movement in the past week.

QQQ made a smaller demand zone at around $438, which is where it is right now. However, I don't think this zone will hold, especially since QQQ has been on a downtrend for the past trading day or two. Even if the zone were to hold, the retracement was already seen on Friday of last week, so I think that QQQ will just break downwards right through that zone. I also think that throughout the next week, QQQ will reach anc bounce off of the major demand zone at around $434. After that, I think it will possibly just go back up to the major supply zone at around $446-$448.

That is what I think will happen to QQQ in the upcoming week, let's see what happens!!

That is it for today's Weekly Recap + Market Predictions post, I hope you enjoyed! Don't forget pictures will be posted below, and I will see you in the next post!

Wednesday:

Friday:

Market Prediction for QQQ Charts: