Hi readers! I have a very important update today. I know it is near the afternoon right now, and trading hours are still going on right now, but this update will cover the trades and adjustments I have made in the past week, on Tuesday, Wednesday, and Thursday. Here is the update:

TUESDAY:

So, on the AMD position, I was profiting well, but unfortunately, I forgot to close the position on the expiration date! Anyways, on Tuesday, I put on an AMD ATM straddle (pictures below) at a strike price of $142. Other than that, I did not do much, as the deltas and thetas for the SPY and QQQ positions were pretty close to 0. Here were the greeks for the positions:

SPY:

+70 Delta, -10 Gamma, +30 Theta, and +70 Vega

QQQ:

+50 Delta, 0 Theta, -10 Gamma, and -20 Vega

WEDNESDAY:

On the AMD position, the 142 calls on the straddle were profiting nicely, and the puts were losing money. I calculated the greeks for that position, and they were +290 delta, -270 theta, +60 gamma, and +220 vega. To bring my deltas near 0, I shorted 10 of the Jan 12 $155 calls. This brought my deltas down to just +50, but my thetas still stayed deep in the negatives at -150. So, to combat the thetas, I decided to do something with the stock. I was initially considering gamma scalping, where I short the stock and buy it back when the stock goes down, but after looking at the AMD charts, I realized that AMD was on a nice up trend and had consolidated for the past 2-3 weeks in the 136 to 142 price range. I thought that AMD might break out soon to the upside, so to combat the theta loss, I decided to actually buy 200 shares of AMD. This was just to cover some of the daily theta loss. The deltas and thetas were pretty close to 0 for the other positions, so I did not want to make any adjustments on those yet. Also, they were making a decent profit.

THURSDAY:

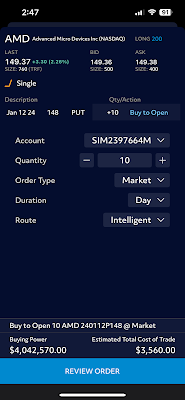

AMD shot up from around 146 to around 148, so my 200 shares were profiting around 700$ and my long calls were deep ITM. The puts and the short calls were losing money, however. I decided to make a simple adjustment, just tightening the long puts. I closed the long 142 puts I had, and I used that credit and an extra $2,000 to purchase 10 of the 148 puts. The expiration cycle on both puts were Jan 12. I left the stock as it was, as I believed that it could go up a bit more before consolidating. I also did not touch the other QQQ and SPY positions, as they were near 0 delta and theta wise, and they were profiting nicely.

That is it for the update, and thank you so much for reading! Happy Holidays!

Tuesday snapshots:

Wednesday snapshots:

Thursday snapshots: