Hi readers! I hope everyone is having a great start to the New Year! This is just an update on the trades/adjustments that I made this week. Here is the update:

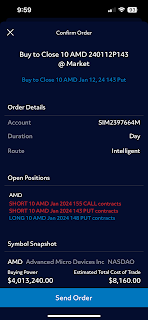

On Wednesday, I first adjusted the AMD position. First, I closed out of the long 142 calls, I closed out of the short 143 puts, and then I shorted the 133 puts, all in the January 12 expiration cycle. I also bought 5 of the 135 calls, again in the January 12 expiration cycle. This was to manage my deltas and maintain them near 0, specifically the deltas and thetas. Then, for my QQQ position, I closed out of the long 405.78 calls. Then, I bought a vertical spread 10 times that consisted of short 401.78 calls and long 400.78 calls. This was all in the January 12 expiration cycle. I did this to also maintain the deltas and thetas in the QQQ position near 0. Some of the adjustments I made were also made to simply tighten the spread.

On Friday, I went ahead and just closed out of my SPY position. I made an overall profit of around $1,160! I was really happy with that position!

One thing that really surprised me, however, was the huge drop in ALL 3 of the underlying stocks I had positions on, right after the New Year as well! AMD, QQQ, and SPY all dropped really heavy, and before that, my positions were very much in the money. After, I had lost about $5,000 on the one day of the drop! I guess this might be a lesson to learn, that stocks either always drop right after New Year or they are very, very volatile right after New Year.

My plan is to just maintain my deltas and thetas near 0 until I can close out of my positions on January 12, which is the upcoming Friday. The reason I want to only close out on my positions when they expire is so that I can learn how to properly manage my positions.

That is it for today's update, thanks for reading and see you in the next update!

Closing SPY position: