Market Monday + Blog Upload Schedule Update (2/19/2024)

Hi readers! This is the Market Analysis post, and I will be talking about my predictions on what will happen to SPY and QQQ in the upcoming week. At the end of the post, I have a small alteration to the upload schedule that I would like to talk about. First, here is the Market Analysis post:

In the past week, QQQ has had a big dip. First, on Monday, it started going down, starting the day at around $439 and ending at around $436. Then, on Tuesday, QQQ opened at around $427, dropping around $10 just on opening. Then, QQQ went back up to $430 in the first 2 hours on Tuesday and then proceeded to drop back to the $427 price range, which was actually a key supply zone. This key supply zone had been respected various times in the past 3 weeks, as QQQ had bounced off of it 3 times previously. Furthermore, that zone was a resistance level before, which QQQ rejected 3 times in late January. Anyways, going back to the previous week, on Wednesday, QQQ opened back up at around $430, and stayed there until the end of trading hours, when QQQ picked up steam and ended at around $433. On Thursday, QQQ went down by a dollar, but then went back up to $430 and stayed there for the second half of trading hours. On Friday, QQQ opened up at around $432 but immediately dropped all the way down to $430 in a single 15-minute candle. But, QQQ bounced back up and went back to around $433, where it rejected and went back to all within Friday. However, near the end of trading hours, QQQ ended up coming back to the $430 area. Off of the past couple days, QQQ has formed a new, smaller support zone at around $430, which QQQ bounced off of 2 times already. Based on this, and since QQQ ended the previous week at the supply zone, I would predict that QQQ will bounce off of the supply zone and continue to go up and hit its previous high point, at around $438-$440. Additionally, I plan on buying shares of QQQ to gamma scalp on my QQQ position.

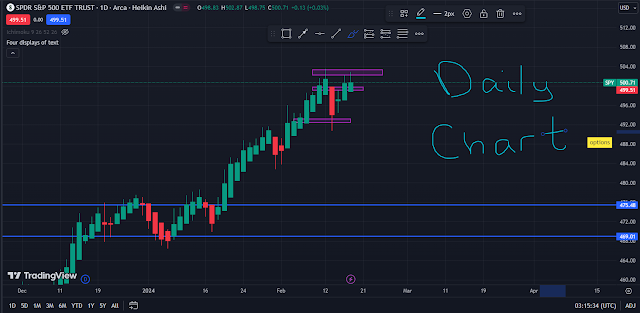

On Monday, SPY opened at $501, went up to $503 by the middle of the day, and then dropped back to $501 by the end of the day, where it ended. On Tuesday, SPY opened all the way down at around $494.50, which was a sudden and unexpected move. SPY did go up to $496, but went down $491. SPY ended up coming back up and ending the day at around $494. On Wednesday, SPY opened all the way up at around $497, and went down to around $495 by the middle of the day. However, SPY quickly picked up steam and ended the day at around $498. On Thursday, SPY opened at near $500, and went up the whole day to end trading hours at around $502. However, on Friday, QQQ went back to $500 in the first 30 minutes, then went al the way back up to $502. Near the middle of the day, SPY went down a dollar and came back up, all within 30 minutes. Unfortunately, SPY came crashing all the way back down, ending the week at near $500. Based on the past week's movements, I can see that SPY had high volatility, and formed a new resistance zone at around $502, which SPY rejected nearly 4 times this past week. SPY also formed a new support zone at $500, which it bounced off of twice on Thursday and Friday. Since SPY is currently at it's new support zone, I would predict that SPY will go back up, to at least $502. When looking at the daily charts, SPY is on a huge upward trend. It has also finished its retracement downwards and is back up to its previous high point. Based on this, I predict that SPY will break out, and skyrocket upwards this upcoming week.

By the way, I am trying out the Heikin-Ashi candlesticks on the charts, so those are the candlesticks being used in the screenshots below.

That is the end of the Market Analysis post. I will be making a small change to the upload schedule, which will be uploading the strategy post in the middle of the week. This will allow me to go more in-depth into options topics and explain them so the general audience can understand the options trading concepts I will explain.

I hope you enjoyed the post, thank you for reading! See you in the next post!

Pictures:

QQQ:

SPY: