Trade Talk Post (Weekly Recap) - 2/18/2024

Hi Readers! In this Trade Talk post, I will be talking about what changes, such as new positions and adjustments, have happened in the past week in my options trading portfolio. Here is the update:

Monday (2/12/2024):

On Monday, the first thing I did was close out of the AMD position, which was in profit by a couple hundred dollars!

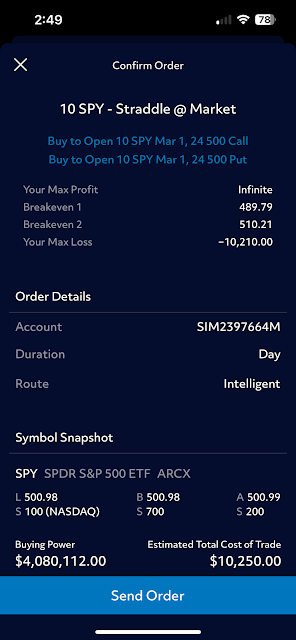

I also opened two new positions, a long ATM straddle on SPY @ $500 strike price and a long calendar/time call spread on QQQ @ $435 strike price. The SPY straddle was in the March 01 expiration cycle, and the QQQ time spread was in the March 01 and February 23 expiration cycles.

Wednesday (2/14/2024):

On Wednesday, I made a lot of adjustments on the QQQ and SPY positions. First, since QQQ had dipped, the short calls were way out of the money and in profit and the long calls were not profiting. So, to tighten the spread, I closed out of the long $435 calls and bought the $432 calls. In case QQQ made a huge move upwards, then I could make a little extra profit with the adjustment than compared to before the adjustment.

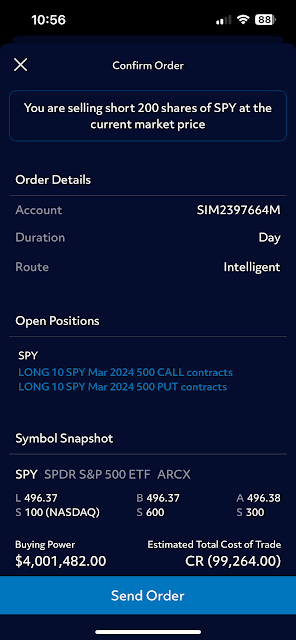

Both positions had theta decay, so I tried gamma scalping both SPY and QQQ to cover the theta loss on that day. I shorted both QQQ and SPY. With QQQ, I shorted 100 shares and was able to make $120 off of the scalp! For SPY, I was not that lucky. I shorted 200 shares, and SPY initially went down but then came back up. To reduce losses, I closed out of the SPY short shares position at breakeven.

Thursday & Friday (2/15/2024 & 2/16/2024):

I did not make any adjustments or changes to the positions on these days, because they were profiting well, especially the QQQ position. On Thursday, the QQQ position was profiting about $2,100 dollars, and maintained that momentum into Friday, when it gained an extra $300 in profit. On Thursday, the SPY position was at a loss of $400, and was at a loss of around $500 on Friday.

Plans for the upcoming week:

For the QQQ position, I plan to buy shares to gamma scalp, as it is currently at a demand zone. For the actual options position, I will just try to maintain the profits and adjust according to the greeks. I will be closely monitoring the thetas and deltas (deltas to hedge against and lower down & theta to gamma scalp accordingly to cover daily decay). For the SPY position, SPY has not crossed either breakeven point, so to take advantage of the low volatility and to cover the daily theta decay, I will short the exact same straddle at the exact same strike price and I will gamma scalp SPY.

This is what I did this past week on my options trading account, stay updated for the posts next week! I will explain the adjustments and changes I actually ended up doing, so stay tuned! Thanks for reading!

Pictures:

Monday: